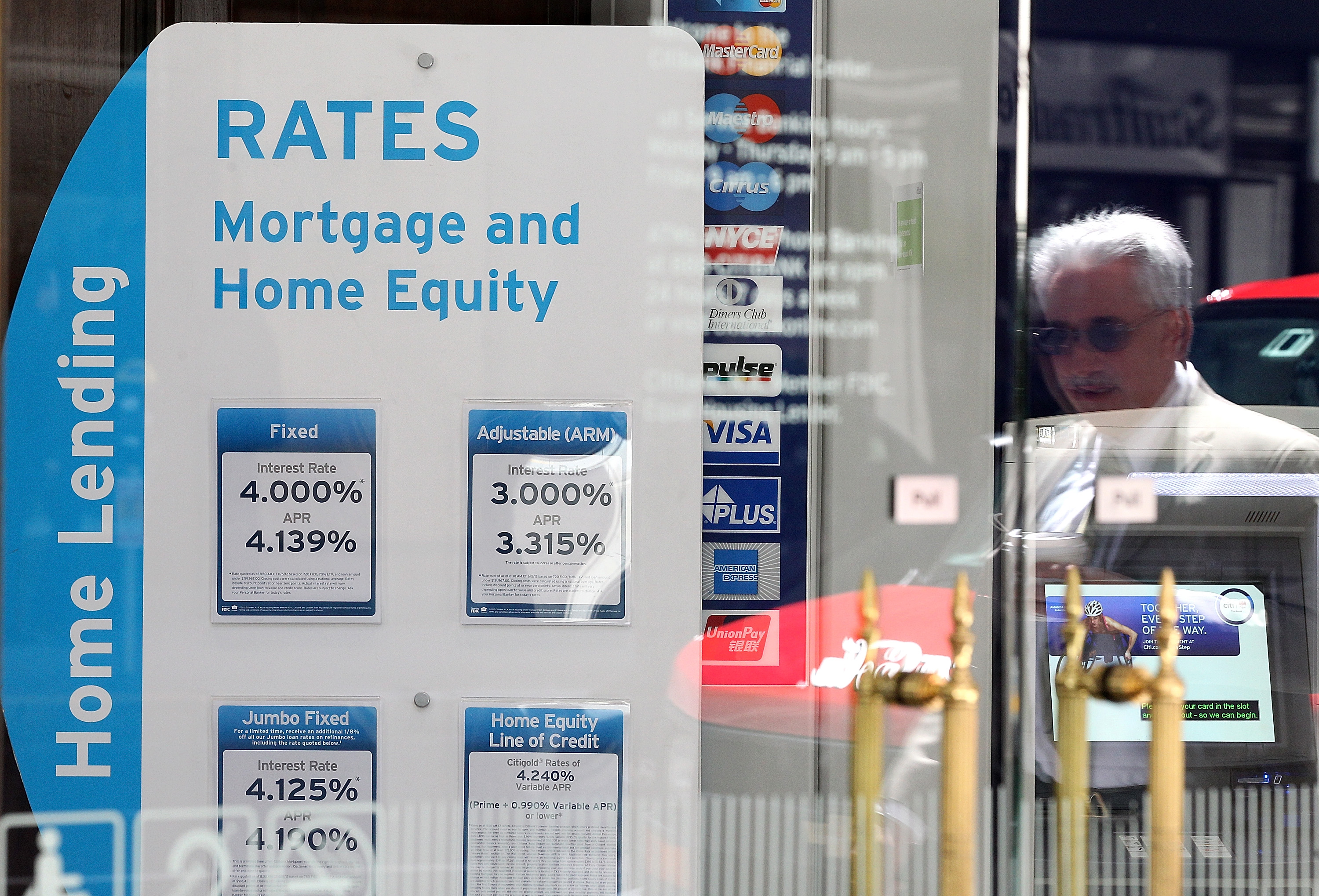

Mortgage rates will experience a significant drop by the end of 2024 but the dip will accompany a shortage of available homes, driving up sales prices for the next three years, the Mortgage Bankers Association (MBA) said.

The rates, which have hit two-decade highs, will fall substantially by the end of next year, lessened by a sluggish economy as moderating inflation and borrowing costs decline, the MBA said during the weekend. But the inventory of homes new to the market is expected to remain low, which will increase purchase costs, the lenders said.

The economy, hit with a confluence of high interest rates, high cost of borrowing plus the expiration of COVID-era savings will lead the U.S. to a recession in early 2024, Mike Fratantoni, chief economist of the MBA, said in a statement. Fratantoni believes that unemployment will rise to 5 percent by the end of next year and inflation will come down to the Federal Reserve’s 2 percent target by mid-2025.

The combination of these factors will help bring down mortgage rates to 6.1 in 2024 and decline further to 5.5 percent the following year, he said.

Since March 2022, the Fed began raising interest rates to battle soaring prices of goods and services to its current range of 5.25 to 5.50 percent, which pushed up the cost of loans.

Fratantoni suggested policymakers were close to done with raising rates, yet it will be a while before they can start cutting, a crucial move to kickstart the moribund housing market.

MBA’s forecast isn’t alone in projecting 6 percent mortgage rates by the end of 2024. The National Association of Realtors anticipates by the 30-year fixed rate mortgage, the most popular loan term for housing borrowers, will fall to that level by the second quarter, according to its economic outlook from August it shared with Newsweek.

“Lower rates should help boost both homebuyer demand and increase the inventory of existing homes, thereby supporting purchase origination volume in 2024,” he said.

Lenders say first-time buyers will drive the demand for homes over the next year as a new generation of Americans hit homeowning age even as they will have to grapple low inventory, high prices and limited credit.

“New-home sales continue to be stronger than existing-home sales, as buyers increasingly turn to newly constructed homes, given the dearth of existing home listings and how competitive the bidding process still is,” Joel Kan, MBA’s deputy chief economist, said in the statement. “Data from our Builder Applications Survey have shown solid year-over-year gains in purchase applications in recent months.”

Fratantoni says a declining economy and inflation drop may suggest to Fed policymakers that they have won their fight against high prices. The Fed suggested in the past that it wants to maintain high interest rates for longer to ensure that inflation is definitively on target.

“We need policy to be restrictive so that we can get inflation down to target,” Fed Chairman Jerome Powell said in September after the central bank decided to hold rates at their current level. “We’re going to need that to remain to be the case for some time.”

The lenders said that record low of loan volumes has shot up the cost of loans. The slow economy next year may push up loan delinquencies.

“In 2024, delinquency rates are likely to increase as unemployment increases and borrowers are stressed by increasing property taxes and insurance and the resumption of student debt payments,” Marina Walsh, MBA’s vice president of industry analysis, said in the statement.

Update 10/16/23, 18:26 p.m. ET: This story has been updated to more context from the National Association of Realtors.